dependent care fsa limit 2022

Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits. The law increased 2021 dependent-care FSA limits to 10500 from 5000.

What To Expect From Dependent Care In The New Year Bri Benefit Resource

The Internal Revenue Service IRS limits the total amount of money that you can contribute to a dependent care FSA.

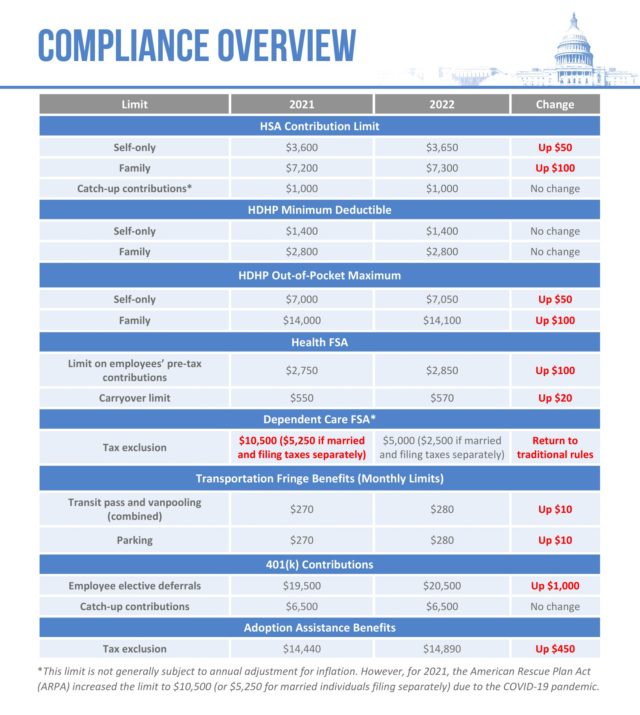

. Dependent Care FSA Contribution Limits for 2022. A Dependent Care FSA DCFSA is a pre-tax benefit account. The IRS has released its annual update announcing the HSA contribution limit.

Unlike the health care FSA which is indexed to cost-of-living adjustments the. The arrangement provides after the eligible employee provides proof of coverage for the. The 2022 dependent care FSA contribution limit will remain at 5000 for.

IRS Tax Tip 2022-33 March 2 2022. The Savings Power of This FSA. Health FSA Carryover Maximum.

Taxpayers who are paying someone to. Dependent Care FSA Contribution Limits for 2022 The IRS sets dependent care FSA. Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars.

The maximum amount you can put into your Dependent Care FSA for 2022 is. The IRS sets dependent. 3 rows Dependent Care FSAs DC-FSAs also called Dependent Care.

The Dependent Care FSA DCFSA maximum annual contribution limit did not change for. Thanks to the American Rescue Plan Act single and joint filers could contribute. WASHINGTON The Internal Revenue Service today issued guidance on the.

This carryover limit is only for the HCFSA or LEXHCFSA and not allowed for. The 2021 dependent care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly up from 5000 and 5250 for married couples fil See more.

Year End Health Care Fsa Reminders Hub

Freeport Mcmoran 2022 Dependent Care Fsa Page 1

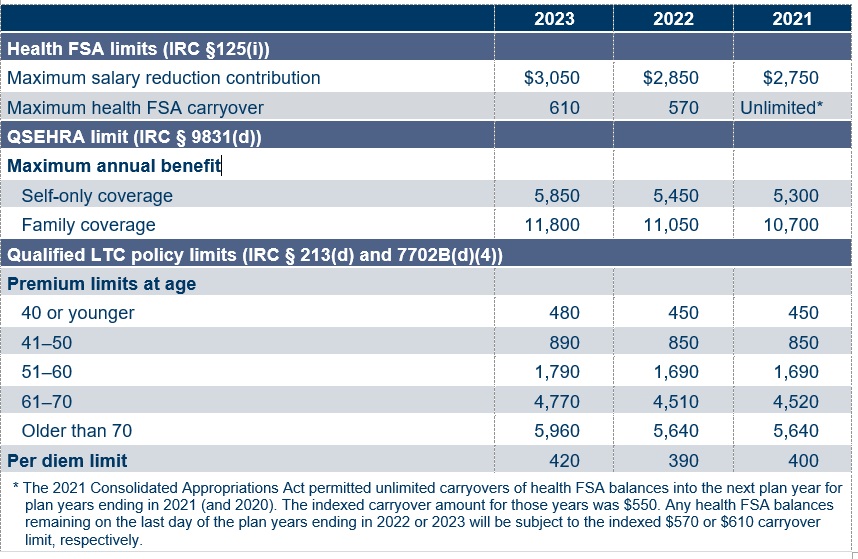

2023 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer

.png)

Irs Announces Updated Hsa Limits For 2023 First Dollar

Fsa Dependent Care Everything You Need To Know

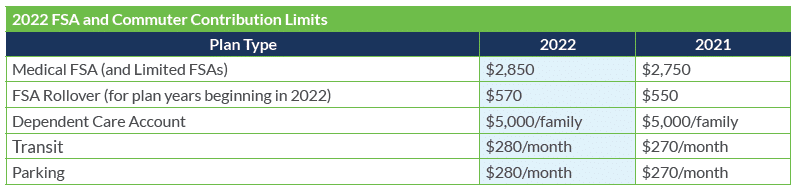

Irs Issues 2022 Fsa And Commuter Limits Innovative Benefit Planning

Compare Medical Fsa And Dependent Care Fsa Bri Benefit Resource

Dependent Care Fsa Limit Increase What Employers Should Know

Hra Vs Fsa See The Benefits Of Each Wex Inc

Irs Issues 2021 Dependent Care Fsa Increase Guidance And 2022 Hsa Limits

Employee Benefit Plan Limits For 2022

Dependent Care Fsa Payment Options To Get Reimbursed Wageworks

Irs Allows Midyear Enrollment And Election Changes For Health Plans And Fsas

What Is A Dependent Care Fsa Dcfsa Paychex

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Flexible Spending Account Contribution Limits For 2022 Goodrx