salt tax new york state

SALT paid by the. Over the weekend New York became the first state to create a state and local tax SALT deduction cap workaroundtwo workarounds in fact since New York does nothing on a small scale.

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Effective for tax years beginning on or after Jan.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

. The New York State NYS 20212022 Budget Act was signed into law on April 19 2021. Democrats from high-tax states like New York New Jersey and California have spent years promising to repeal the cap and are poised to lift it to 80000 through 2030 before reducing it back to. The state and local tax deduction or SALT deduction for short allows taxpayers to deduct certain state and local taxes on their federal tax returns.

New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021. The Budget Act includes a provision that allows partnerships and NYS S corporations to elect to pay NYS tax at the entity level in order to mitigate the impact of the 10000 cap on SALT deductions. 16 2020 New York legislation was submitted to impose an unincorporated business tax UBT on partnerships and limited liability companies that are treated as.

The IRS responded in 2019 to these potential workarounds by issuing regulations to close the door on the state workarounds. 1 2021 electing entities are taxed at the following marginal rates. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here.

Since its purpose is to provide a SALT limitation workaround to New York State taxpayer individuals the tax is imposed at rates equivalent to the current and recently increased New York State personal income tax ratesthat is at 685 percent of pass-through entity taxable income of up to two million dollars with excess income taxed at rates of between 965 percent. If this person also pays 40000 a year in real estate. Yet while the newly adopted budget encourages high.

Whats worse is that the law disproportionately hurts Democratic states like New York which already contributes 356 billion more annually to the federal government than it gets back. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. PUBLISHED 549 PM ET Apr.

According to WalletHub when you measure taxes on individual. Legislation enacted by New York State will allow a New York City City partnership or resident S corporation to elect to be subject to a new 3876 entity level tax. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New.

New York made up the next highest percentage of national SALT. New Yorks SALT Avoidance Scheme Could Actually Raise Your Taxes. Scott is a New York attorney with extensive.

New York is taking another run at repealing SALT cap. New York New Jersey Illinois Texas and. Andrew Cuomos spin on the tax hikes in the state budget approved this month is this.

New York State and other states began to work on a solution to alleviate the effects of the limitation. This provision is not available for publicly traded partnerships. In 2014 3414 of New York tax returns included a deduction for state and local taxes.

An owner of the electing entity is entitled to a credit against hisher City personal income tax equal to the owners direct share of City passthrough entity tax PTET paid. The Tax Cuts and Jobs Act capped it at 10000 per year consisting of property taxes plus state income or sales taxes but not both. The average size of those New York SALT deductions was 2103802.

New York has issued long-awaited guidance and clarifications on the Pass-Through Entity Tax PTET via a Taxpayer Services Bulletin issued on August 25 2021 TSB-M-21 1C 1I. Residents of New York take the highest average deduction for state and local taxes according to IRS data. By Nick Reisman New York State.

Since its purpose is to provide a SALT limitation workaround to New York State taxpayer individuals the tax is imposed at rates equivalent to the current and recently increased New York State. The cap disproportionately affected those not subject to the alternative minimum tax AMT which denies certain tax breaks including the SALT deduction to subjected individuals. One of these provisions limits the Federal itemized deductions for State and Local Tax SALT to 10000.

For example a New York taxpayer with 1500000 in taxable income would pay 102750 in state income tax 685. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. 685 for incomes not over 2 million 965 for incomes over 2 million but not over 5 million 103 for incomes over 5 million but not over 25 million and 109 for incomes over 25 million.

The Pass-Through Entity tax allows an eligible entity to pay New York State tax. New York estimates its taxpayers will end up paying 121 billion in extra federal taxes from 2018 to 2025 because of the SALT cap. They wont really count when the 10000 cap on state and local tax deductions is repealed by Congress.

California filers accounted for 21 of national SALT deductions in 2017 based on the total value of their SALT deductions. The federal Tax Cuts and Jobs Act of 2017 eliminated full deductibility of state and local taxes SALT effectively costing New Yorkers 153 billion. Friday December 18 2020.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

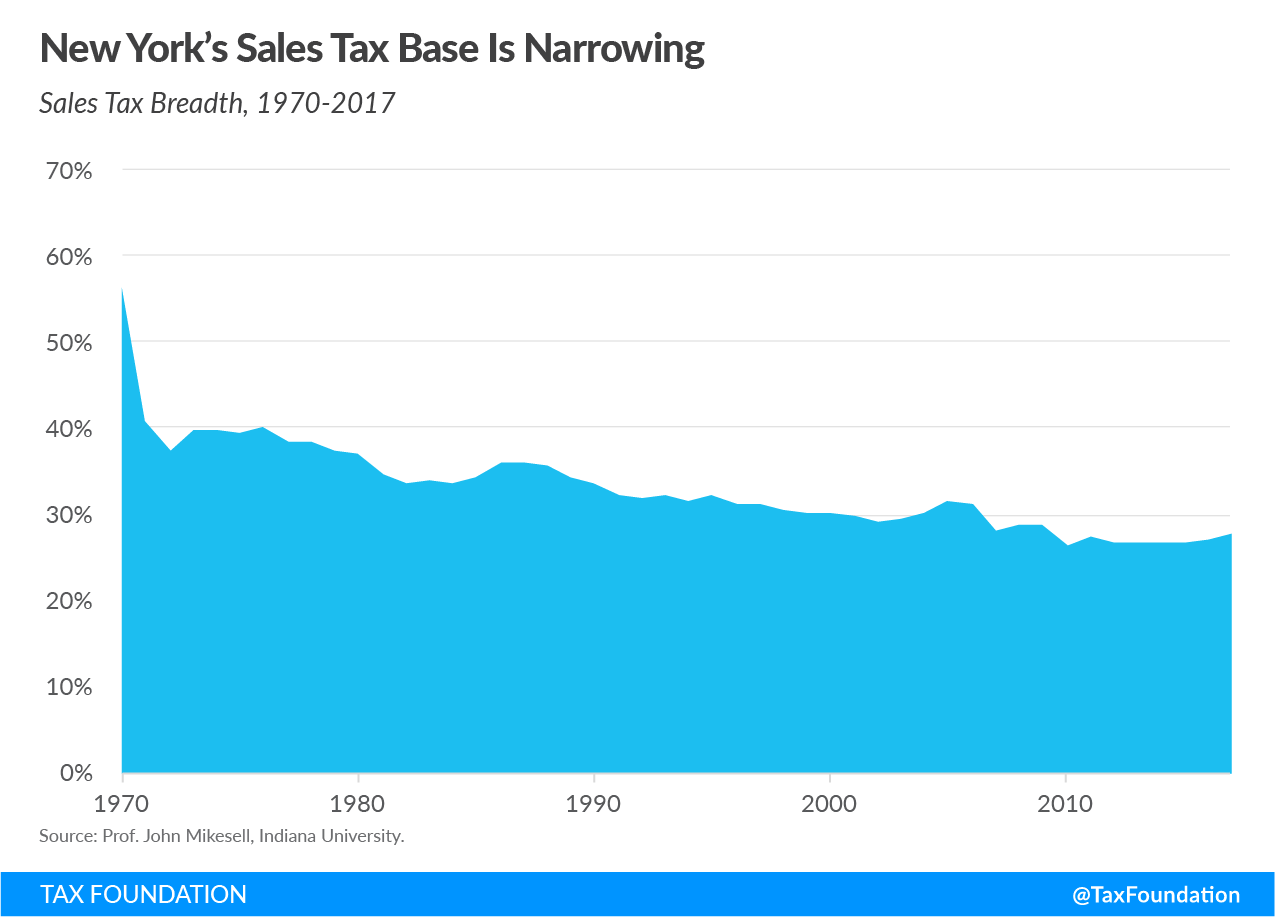

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

/cdn.vox-cdn.com/uploads/chorus_image/image/70105881/1236366936.0.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

How Does The Deduction For State And Local Taxes Work Tax Policy Center

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Ny S Leaky Gas Taxes Empire Center For Public Policy

Pass Through Entity Tax 101 Baker Tilly

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

State And Local Taxes What Is The Salt Deduction Taxes Us News

Salt Cap Confounds Doomsayers As Fears Of Exodus Prove Overblown Bloomberg

Coping With The Salt Tax Deduction Cap Cpa Practice Advisor

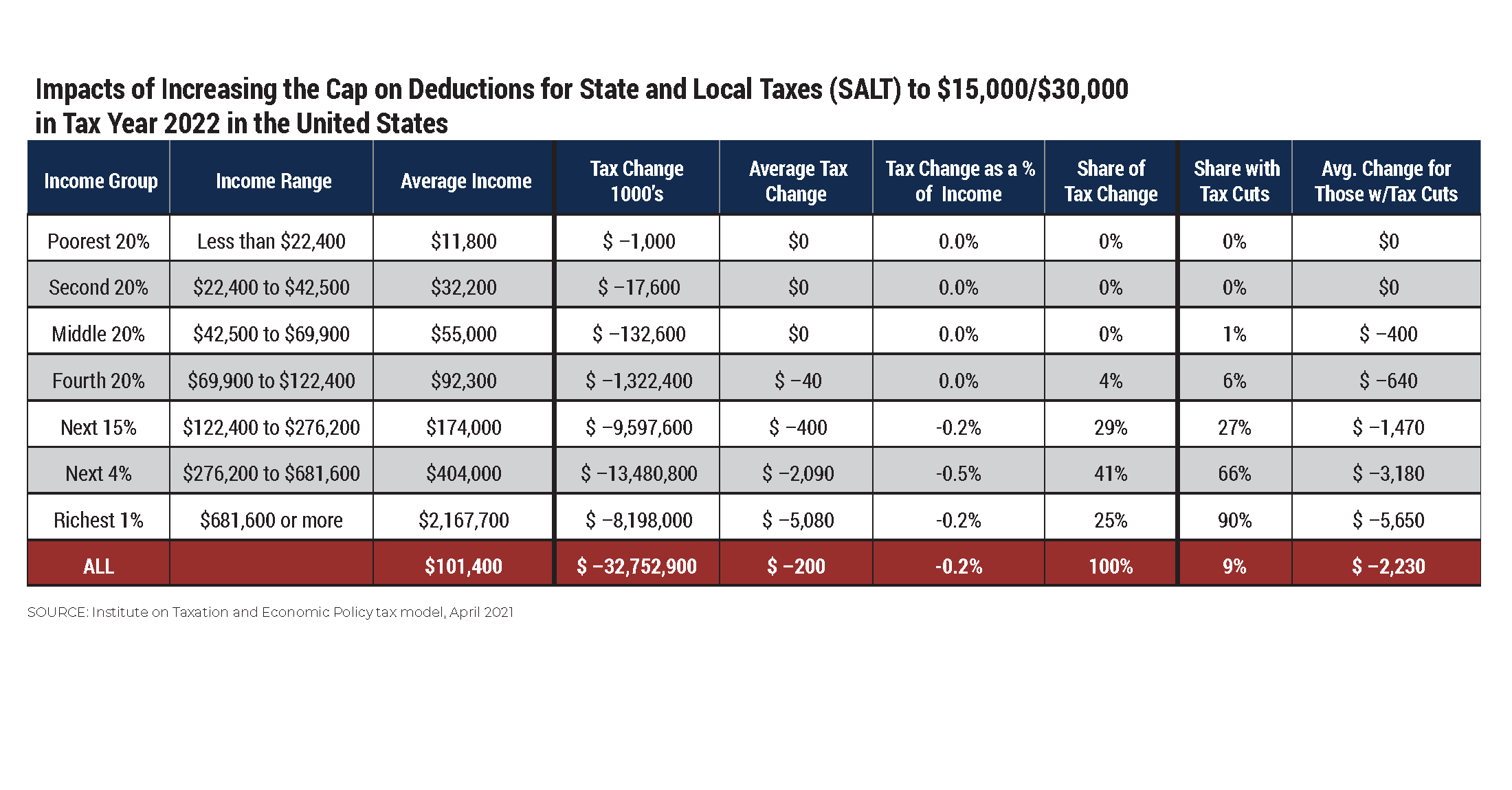

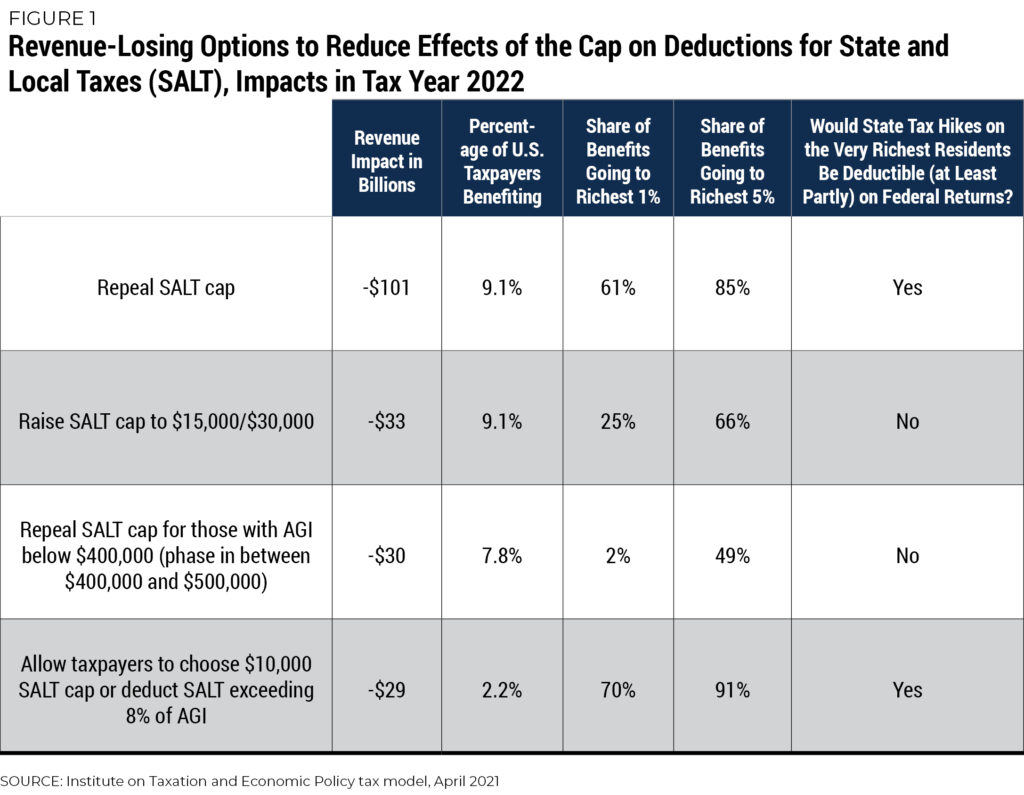

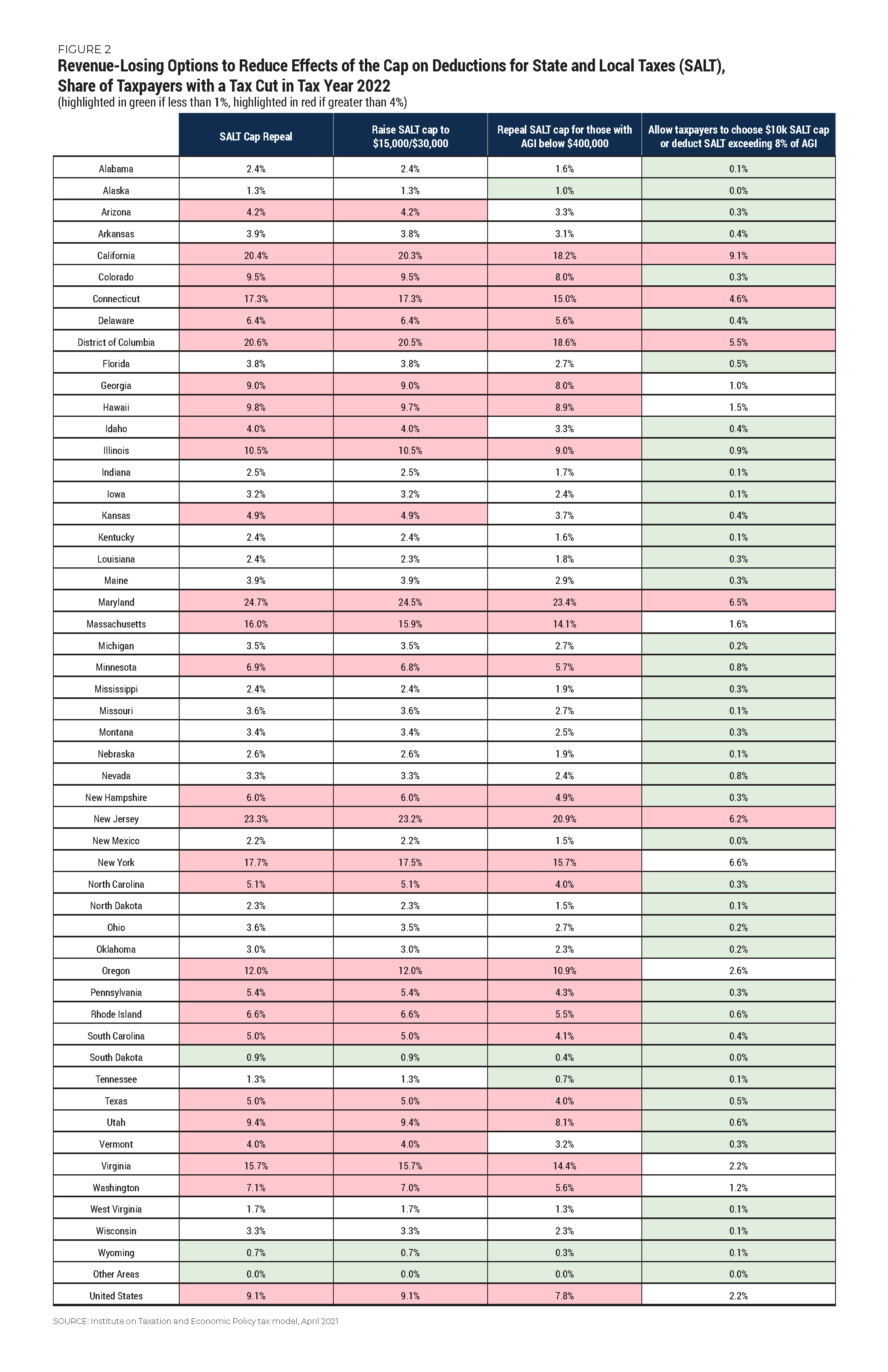

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Why This Tax Provision Puts Democrats In A Tough Place Time

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep